Introduction

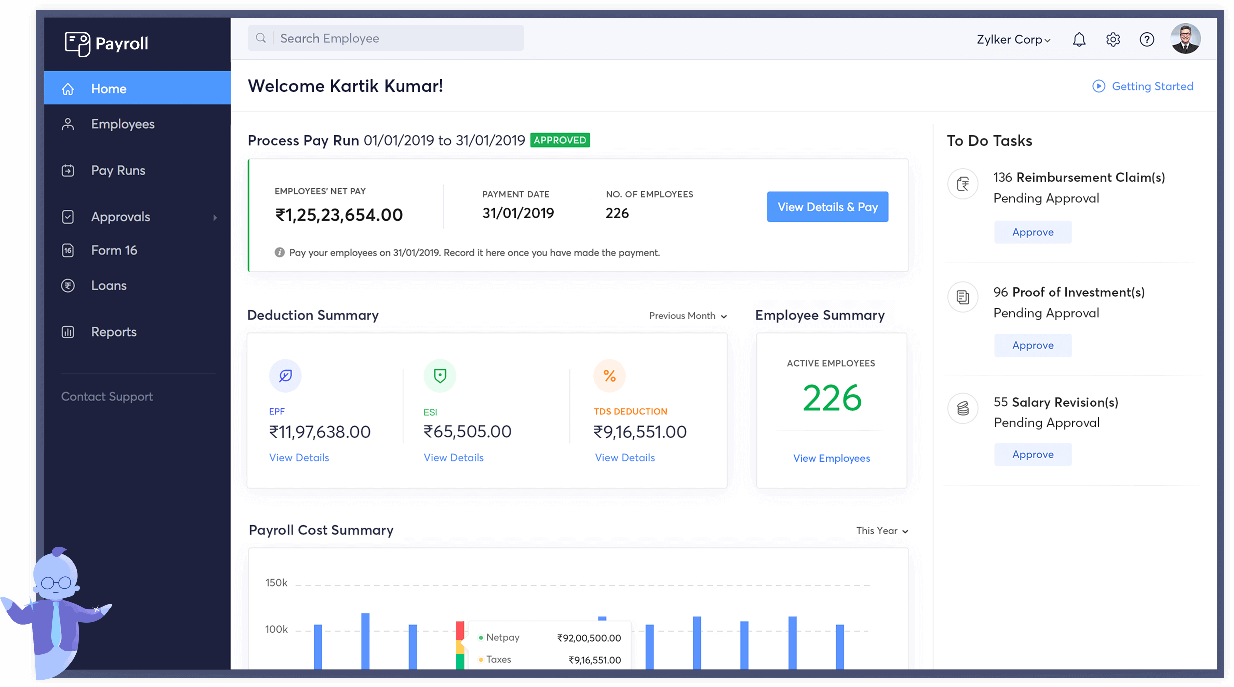

In the fast-paced world of business, time is money, and efficiency is paramount. Nowhere is this truer than in payroll management – a critical function that can make or break an organization's success. With Zoyo Payroll, businesses can revolutionize their payroll operations, driving efficiency, accuracy, and compliance to new heights. Zoyo Payroll is a comprehensive payroll management solution that offers a wide range of features and functionalities designed to streamline processes and enhance productivity.

Automated Payroll Processing Reducing Manual Workload

One of the most significant advantages of Zoyo Payroll is its ability to automate various aspects of payroll processing. Traditional payroll management often involves manual data entry, which is not only time-consuming but also prone to errors. With Zoyo Payroll, mundane tasks such as calculating salaries, deductions, and taxes are automated, freeing up valuable time for HR personnel to focus on more strategic initiatives. By eliminating manual intervention, Zoyo Payroll minimizes the risk of errors and ensures accuracy in payroll calculations.

Employee Self-Service Portals

In today's interconnected business environment, integration is paramount for smooth operations. Zoyo Payroll seamlessly integrates with other HR and accounting software platforms, allowing for seamless data transfer and synchronization. Whether it's syncing employee data with time and attendance systems or sharing payroll information with accounting software, Zoyo Payroll streamlines processes here and eliminates duplicate data entry, enhancing overall efficiency.

Enhancing Connectivity

Integration is key to optimizing business processes and enhancing efficiency. Zoyo Payroll seamlessly integrates with other HR and accounting software platforms, allowing for smooth data transfer and synchronization. Whether it's syncing employee data with time and attendance systems or sharing payroll information with accounting software, Zoyo Payroll streamlines processes and eliminates duplicate data entry, improving overall efficiency and data accuracy.

Empowering Your workforce

Staying compliant with regulatory requirements and tax laws is essential for any organization. Zoyo Payroll simplifies compliance management by staying up-to-date with the latest regulatory changes and automatically applying them to payroll processing. Whether it's tax updates, labor laws, or employee benefits regulations, Zoyo Payroll ensures that your organization remains compliant, minimizing the risk of fines and penalties.

Expandability and Workability

As your business grows and evolves, your payroll needs may change accordingly. Zoyo Payroll offers scalability and flexibility to adapt to your organization's changing requirements seamlessly. Whether you're expanding your workforce, opening new locations, or introducing complex payroll structures, Zoyo Payroll can accommodate these changes with ease. Its modular design allows you to customize the platform according to your specific needs, ensuring that it remains a reliable payroll solution regardless of your organization's size or industry.

Enhanced Data Security

Protecting sensitive payroll information is paramount in today's digital age. Zoyo Payroll prioritizes data security and employs robust measures to safeguard payroll data from unauthorized access, breaches, or cyber threats. With features such as encryption, multi-factor authentication, and regular security updates, Zoyo Payroll provides peace of mind knowing that your payroll data is safe and secure.

Conclusion

In conclusion, Zoyo Payroll is a game-changer for organizations looking to maximize efficiency and streamline payroll operations. With its advanced features, seamless integration, and commitment to compliance and security, Zoyo Payroll empowers organizations to focus on strategic initiatives and drive business growth.